Google Ads

Friday, November 1, 2024

Clarkenomics Jamaica

Thursday, December 8, 2022

The arrival of Venezuelans seeking better lives has strained the economies—and societies—of Latin American host countries

Venezuela’s Migrants Bring Economic Opportunity to Latin America

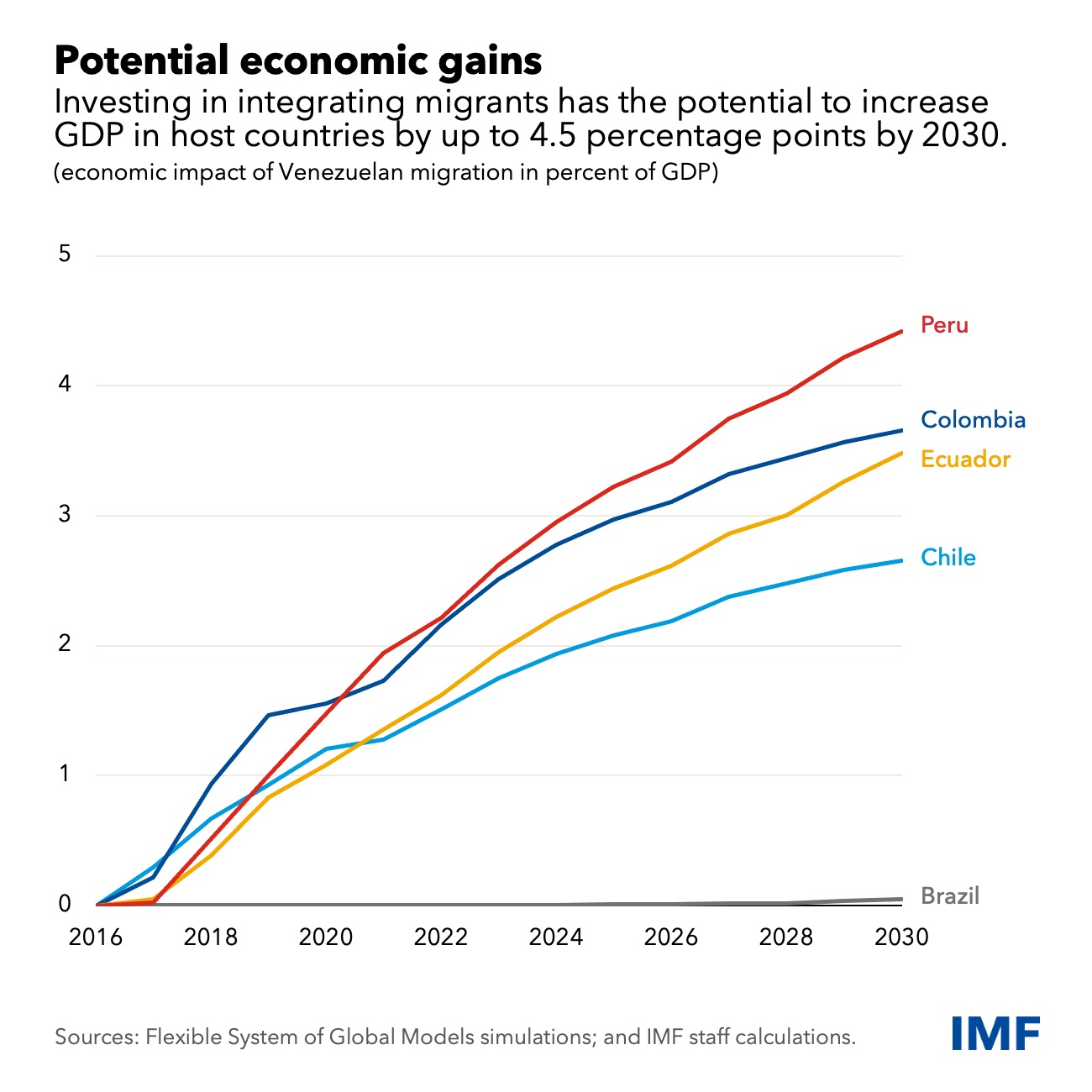

By promptly integrating migrants, the economies of host countries stand to increase their GDP by as much as 4.5 percentage points by 2030

Between 2013 and 2021, Venezuela’s gross domestic product is estimated to have declined by more than 75 percent, the most for a country not at war in the last 50 years. The COVID-19 pandemic compounded the country’s economic and humanitarian crisis, and in 2020 more than 95 percent of Venezuelans were living below the poverty line.

The arrival of Venezuelans seeking better lives has strained the economies—and societies—of Latin American host countries that are already balancing tight budgets, especially since the pandemic.

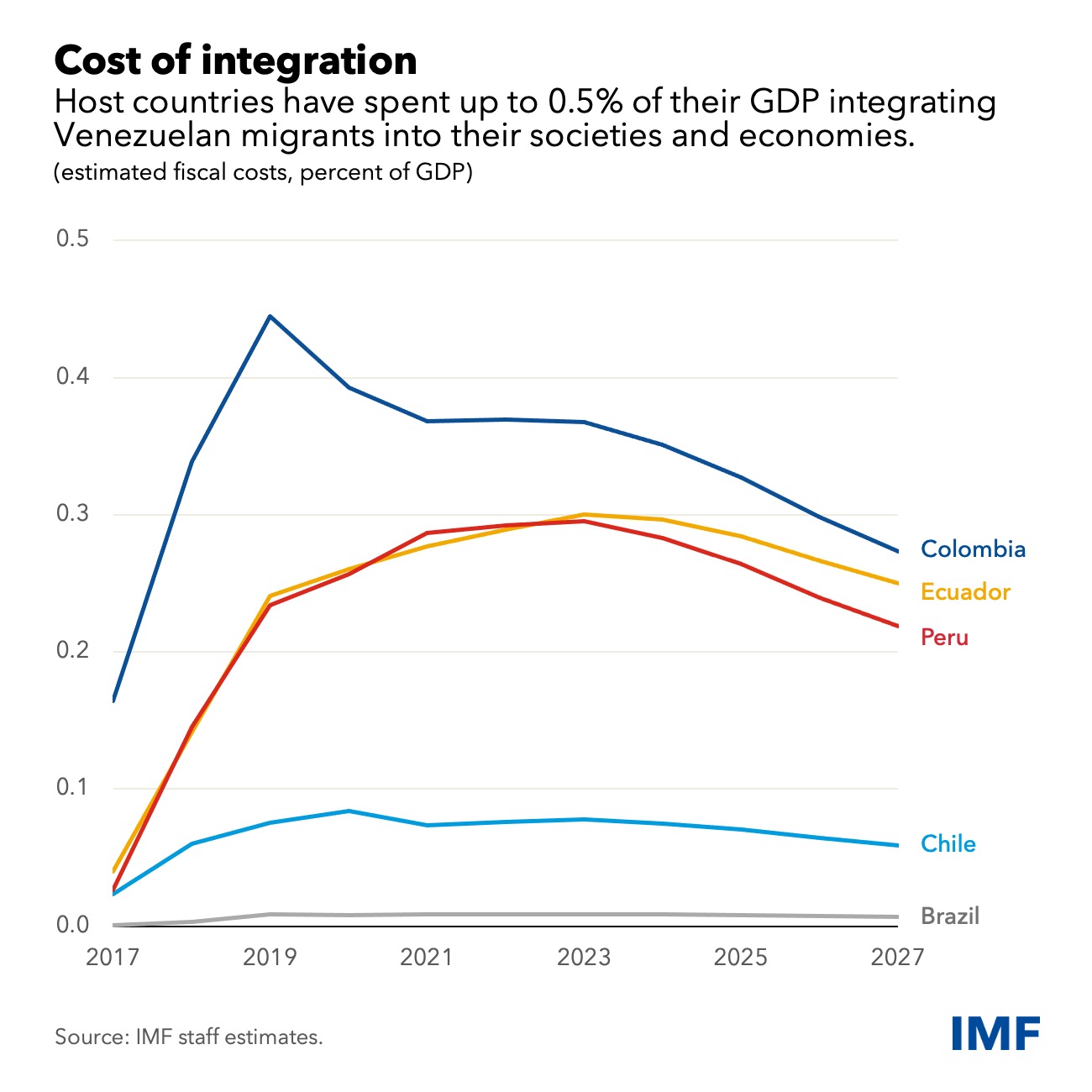

Colombia, which has received the most Venezuelan migrants, estimated spending about $600 per migrant in 2019. This covered humanitarian aid, healthcare, childcare, education, housing, and job-search support. With more than 2 million arrivals, this translates into $1.3 billion in assistance. In 2019, this cost peaked at 0.5 percent of Colombia’s GDP.

In the long term, however, this investment has the potential to increase GDP in host countries by up to 4.5 percentage points by 2030, as we find in our latest research on the spillovers from Venezuela’s migration.

To reap the benefits from migration, host countries need to integrate the new arrivals into the formal labor force—and society—by promptly offering them work permits and access to education and healthcare.

Migration flows

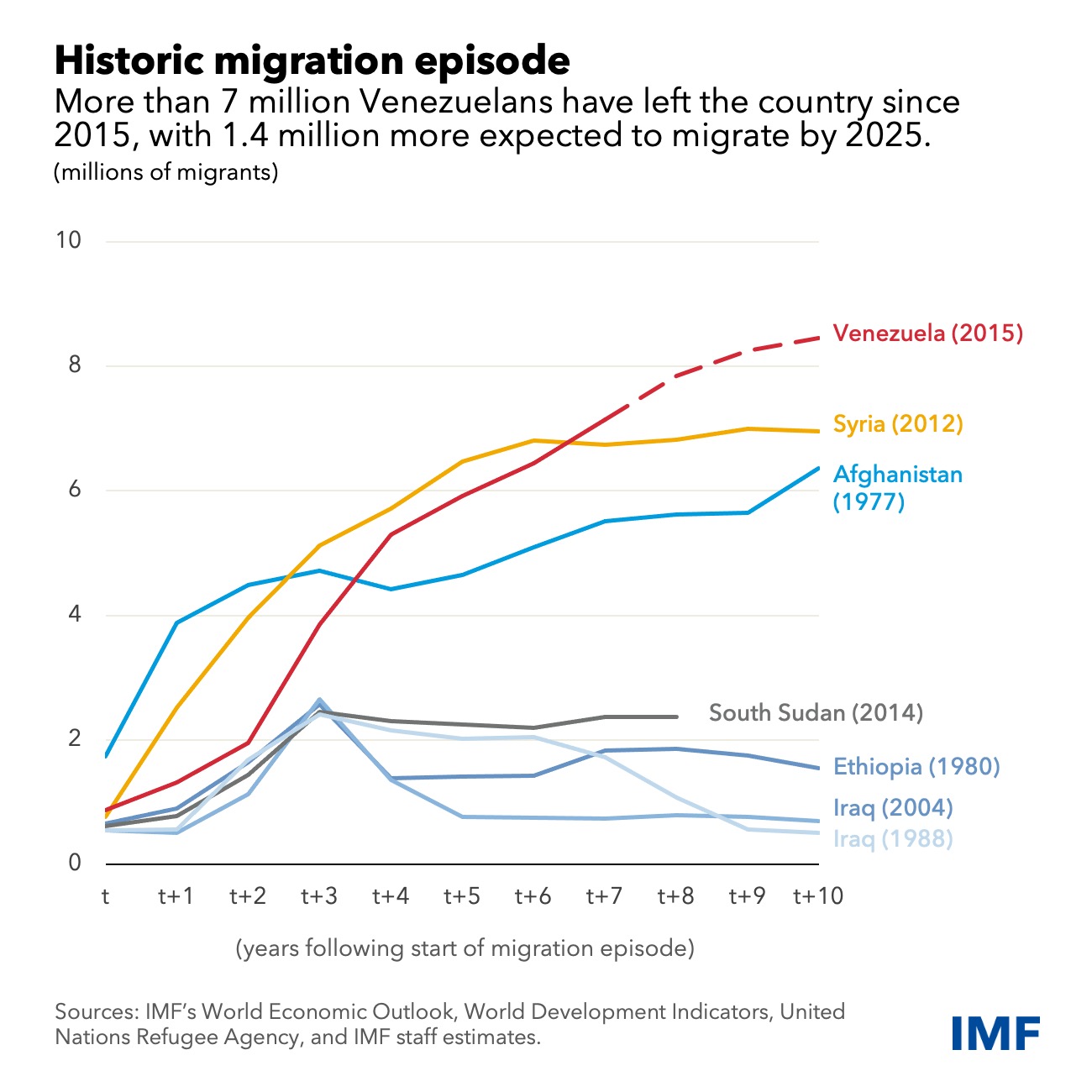

After a brief interruption during the pandemic, when many countries closed their borders, migration from Venezuela has resumed and is expected to continue in the coming years, although at a slower pace.

We estimate that Venezuelan migrants will number around 8.4 million by 2025—more than 25 percent of the country’s population in 2015.

The characteristics of migrants have evolved as the economic crisis intensified. The first wave of migrants were mostly professionals with high levels of education. The second consisted of middle-class young people with a university degree. Since the economy collapsed in 2017-2018, migrants have tended to be from low-income households and with lower levels of education.

Overall, the demographic profile of Venezuela’s migrants is like that of the local population in host countries. Almost two-thirds are of working age and almost half are female.

Most have settled in other Latin American countries, while some have migrated to North America and Europe, mainly the US and Spain.

While Colombia remains the main destination, Chile, Ecuador, and Peru have also received sizable flows, with their combined number of migrants exceeding 2 million, more than 3 percent of the local population on average.

Effect on labor markets

Our research finds that Venezuelan migrants—many of them more educated than the local populations—face higher unemployment, are more likely to initially work in the informal sector, and earn less than the local workers.

We didn’t find evidence that migrants are displacing domestic workers, although we have seen downward pressure on wages in the informal sector.

The wage gap between domestic and migrant workers grows with the level of education, which suggests a misallocation of human capital—workers’ skills, knowledge, and expertise—as educated migrants tend to only find unskilled jobs. On average, domestic workers earn about 30 percent more than migrants.

Cost and benefits

Our analysis finds that providing migrants with humanitarian assistance and access to public services carries a sizable fiscal cost and puts pressure on the budgets of host countries, as the Colombia example shows.

But the analysis also identifies large medium-term gains in productivity and growth resulting from an increase in the labor force and better alignment of migrants’ human capital with jobs. These gains are greater for countries that receive larger and more educated migrant flows relative to the domestic population.

We estimate that, with the right support and integration policies, migration from Venezuela has the potential to increase real GDP in Peru, Colombia, Ecuador, and Chile by 2.5 to 4.5 percentage points relative to a no-migration baseline by 2030.

We also project that the cost of integrating migrants would narrow over time as migrants join the labor force, increasing economic activity and expanding the tax base.

Continued support

Early in the migration crisis, countries in Latin America welcomed Venezuelan migrants and provided support in the form of visa waivers, mobility cards, and access to humanitarian assistance, healthcare, education, and childcare. Migrants also received work permits and credentials to help them integrate into the labor market.

However, in 2018 and 2019, we saw a shift in policies as migration flows intensified. While some countries introduced new programs to facilitate the integration of migrants, others made it harder for Venezuelans to enter by requiring additional documentation.

Countries should continue supporting migrants and helping them integrate into the formal sector so they can find jobs that are in line with their human capital and increase productivity in the economy.

This will require improving transitional arrangements and asylum systems, bringing in migrants into the health and education systems, and formalizing migrant workers by giving them work permits and accelerating the accreditation of skills and education.

To cover the costs of implementing these policies, countries should seek help from donors and international institutions. The IMF is analyzing the impact of migration and coordinating with the United Nations High Commissioner for Refugees and other relevant agencies to help countries access funding sources.

Countries in the region should also agree on a coordinated response to the migration crisis, in which each one contributes its fair share to the support and integration of migrants.

Tuesday, December 10, 2013

The potential impact of value added tax (VAT) on The Bahamas

IDB: VAT will lead to higher growth, lower debt, lower unemployment IDB study assumes all additional revenue goes to paying down debt

By ALISON LOWE

Guardian Business Editor

alison@nasguard.com

Nassau, The Bahamas

Although projected to lead to a decline in disposable income at all levels, a newly-released model prepared for the government projects that value-added tax (VAT) will lead to higher gross domestic product (GDP) growth and tax revenue, decreased debt, lower unemployment and lower inflation after an “initial surge” in the first year.

The model and accompanying report, prepared by the Washington, D.C.-based Inter-American Development Bank, suggest that real GDP growth will be higher relative to baselines once VAT is implemented “especially” if VAT is implemented at 15 percent.

Lower unemployment is anticipated by the IDB model in light of a projection of higher tax revenue and the assumption that with this, there would be lower levels of government borrowing which would make it easier for the private sector to borrow, invest and stimulate employment.

Meanwhile, the expectation of a decline in public debt levels is said to depend on the assumption that all of the “additional revenue” generated through fiscal reform would be “directed toward debt reduction”.

The IDB study supports the government’s claims that VAT will lead to no more than an additional three to four percent rise in price levels above normal inflation in the first year, and has been taken by the government to support the case for the implementation of VAT as the cornerstone of the government’s fiscal reform program aimed at reducing debt levels.

However, the IDB states clearly that VAT, particularly at 15 percent, as opposed to a lower rate, would have a detrimental effect on poverty levels without increases in social spending.

Released on Friday along with an accompanying report, it was prepared on behalf of the government to ascertain the potential impact of a VAT on The Bahamas.

“Tax reform cannot be defined and put in place without in-depth studies of its impact on growth, income distribution, fiscal cost, economic efficiency and a comprehensive tax policy and administration reform. Transparency and predictability rest on the best possible estimates of the revenue consequences of reform that available data allows,” states the IDB report.

In this regard, the model looks at the effect of VAT at varying rates on economic growth, inflation, tax revenue, public debt, poverty, employment and the distribution of income.

It has been much anticipated by the Coalition for Responsible Taxation, which is hopeful of using it in particular to look at what VAT’s impact would be on the economy but also what the potential alternatives might be.

The model, described by the IDB as an “economy-wide” one that “describes the behavior of producers and consumers and the linkages among them”, will be shared with members of the coalition, along with staff from various government agencies, today.

The government said in a statement accompanying the release of the study that it supports its plans to implement VAT on July 1, 2014.

“The study predicts that the introduction of VAT, alongside other reforms to reduce the public debt, would have positive economic and fiscal benefits.

“The IDB’s results are consistent with expectations for the type of fiscal reform package that is being considered for The Bahamas. Reducing distortionary taxes on business activities, and placing more direct emphasis on consumption taxes, would stimulate a projected increase in national savings and investments.

“The private sector investment climate would also benefit from expanded access to financing that would no longer be needed to fund government deficits. These are forecasted to contribute to stronger growth potential and reduced unemployment, which would be felt across all broad sectors of the economy.”

The Coalition for Responsible Taxation declined to comment on the results of the study yesterday, which were presented in a 165-page report published on the government’s website.

Robert Myers, co-chair for the coalition, said he would reserve comment until he had met with the IDB today and had a “better review” of the document.

Speaking prior to the release of the study on Friday afternoon, Gowon Bowe, co-chair of the Coalition for Responsible Taxation, said the group was eagerly awaiting the model, and in particular, whether it predicts the possibility of economic growth and only moderate price level increases as the key determinants of whether the private sector advocacy group can accept value-added tax (VAT) as a solution to the country’s fiscal challenges.

“That’s a piece of information that is an integral part of looking at how it will impact the economy. The most important thing is to look at empirical information now to make a determination; there’s been a lot of emotion that’s gone into it up to this point,” said Bowe.

He added: “The pipe dream would be that the model says we would have economic growth with minimal price increase impact. I think there’s sufficient experience that when you take money out of the economy through tax that has a negative impact on economic growth because you are taking money out of the pockets of consumers, but what we will be looking for is whether the price increase is not as high as 10 to 15 percent, which a lot of us are concerned about, and that it is based on good data and is a reliable model. That will give a level of assurance that [VAT] would be positive and not negative.”

However, Bowe noted that the coalition would still harbor concerns about the capacity of the government to successfully administer the VAT, notwithstanding that ministry officials “have placed great hope in the inherent checks and balances in a VAT system”.

The study looks at 16 alternative scenarios, which involve applying different rates of VAT, hotel tax, average import tariff rates and social “safety net” spending, with VAT ranging from 7.5 percent to the proposed 15 percent.

It does not appear to specifically address the question of what happens under a scenario in which there is significant non-compliance or ineffective administration of the VAT, a point which the coalition and other private sector stakeholders have expressed concerned about with respect to VAT.

It also does not appear to consider the potential outcomes should the government not direct all additional revenue from VAT implementation towards reducing its debt levels.

December 09, 2013

Friday, October 2, 2009

Unemployment rate inches higher in Latin America and Caribbean, UN reports

2 October 2009 – The urban unemployment rate in Latin America and the Caribbean has climbed slightly to 8.5 per cent in the second quarter of 2009, with the United Nations forecasting that rate will stay constant through the end of the year.

This marks a 1 per cent rise in unemployment from last year, which means that 2.5 million more people have joined the 18.4 million people out of work in the region, according to a bulletin published by the UN Economic Commission for Latin America and the Caribbean (ECLAC) and the International Labour Organization (ILO).

The second quarter saw exports contract in response to sluggish demand on global markets, while remittances and foreign direct investment also plummeted due to the global financial turmoil, it said yesterday.

“Since the end of 2008, the countries of the region had started to implement countercyclical policies – albeit with significant differences – in an effort to use public spending to counter flagging investment and consumer-spending levels and boost aggregate demand,” according to the bulletin, the second joint effort by the two UN agencies.

Gross domestic product (GDP) has contracted nearly 2 per cent in the region so far this year,

Labour-market trends observed in the first half-year, together with the forecast for a 1.9 per cent decline in regional GDP in 2009, suggest that the average annual rate of urban unemployment in the region will be close to 8.5 per cent.

“Youth have paid a high cost for the crisis or economic slowdown, given that unemployment among youths has increased significantly,” the bulletin said.

But it said that there are signs that the worst of the economic crisis has already been seen in mid-2009, with signs of recovery, including an end to production declines.

“Public investment can undoubtedly be a powerful tool for creating jobs and boosting the economy in times of crisis,” ECLAC and ILO said, also calling for emergency employment programmes.

Boosting public investment to spur job growth entails a lag, they said, underscoring the need for speeding up projects and execution of existing resources in the short term.

UN News